Many homeowners worry that filing an insurance claim means their homeowner’s insurance premium will go up. While it is possible for your rates to increase when you make a claim, most homeowners make the most of the situation by filing claims after their home suffers storm damage and requires serious roof repairs or replacement. At the end of the day, it really depends on your policy and situation. So today, we’re addressing this common question among homeowners: Does my homeowner’s insurance go up after I file a claim?

The answer to this is complicated. We’ll explain further in a bit. But for the most part, an insurance company can increase your premium as much as they want, for any reason they want to. Traditionally, increases tend to target the “higher-risk” properties—homes that are harder to sell and less valuable homes. Of course, things like the age of the roof or the age of the heating system can play into this decision.

However, in general, premium increases aren’t done lightly by insurance companies. The business model for insurance is built around offsetting costs with premiums. If they start to see that customers are filing claims monthly, they’ll start to lose money. If too much money is being lost in the bottom line, the company will either increase premiums or simply pull coverage for those high-risk members.

So let’s dive into what you can expect when or if you do file an insurance claim and learn how to prevent an increase altogether.

Common Types of Insurance Claims Filed on Your Home

For the most part, homeowner’s insurance claims fall into one of just a few categories. They are either related to weather, property damage, personal injury, or theft.

Wind, Hail, and Storm Damage

Severe weather damage makes up the highest percentage of claims filed, often with wind and hail damage at the top of the list. Hurricanes, tornadoes, and severe thunderstorms can bring damaging winds of 50 mph or more. The wind itself has to be pretty fast to damage your roof on its own, but blowing debris and knocked down trees from strong gusts are most likely the reason for your damage. This kind of damage can easily exceed your insurance deductible, so filing a claim is a no-brainer to get your repairs done.

Lightning Damage

Lightning damage from storms is also a major reason for home insurance claims. Lightning can easily strike your home, despite it having no high points—it’s a myth that lightning will strike the highest point. It can strike anywhere, anytime, even miles away from an actual storm cell. Lightning strikes seem to be on the rise as more and more smart homes pop up, with far more wiring and electronic features than ever before. It’s like a target for a lightning strike due to the added electrical components instead of a traditional home.

The Insurance Information Institute shows that in 2019 nearly 77,000 claims were filed for lightning damage claims. Lightning strikes on your home don’t necessarily start a fire, which can happen, but more often, it damages your electrical work, sometimes resulting in a fire. It can also damage your roof, siding, and chimney due to its extreme heat and energy.

Fire Damage

In 1666 a tragic fire swept across central London, devastating the area and damaging over 13,000 homes. A brief history of the incident shows that The Great Fire of 1666 is where the first home insurance came about. The first insurance policies only covered fire damage, but by 1690 nearly 1 in 10 households held that coverage.

That brings us to the next most frequently filed claim—fire damage. But seeing as home insurance was created for fire damage protection, it’s almost guaranteed you have coverage in your policy. A fire damage claim is often one of the most expensive as it can spread very quickly and damage multiple areas of your home.

Frozen Pipes & Water Damage

The dreaded water main burst—as much as homeowners try to prevent it from happening, it still can. Frozen, damaged, and burst pipes cause a headache of water damage in your home’s basement and lower levels. A pipe can burst when the water inside freezes, causing the molecules to expand and thus bursting the pipe.

A burst pipe doesn’t mean an explosion, but it can cause excessive leaking and flooding in your home. Pipes that lead into your home from outside or those exposed to cold winter air are most susceptible. Prevention includes insulation and flushing the pipes to make sure they don’t fully freeze.

When the unthinkable happens, and you find yourself with a water-filled basement, it’s important to file a claim for the damages. The water can be cleaned up relatively quickly. Still, with walls and baseboards getting wet, the risk of mold growth is very high, and further damage must be prevented and mitigated with proper drying techniques or a total replacement.

Property Damage, Theft & Liability

The smallest segment of claims (around 7%) is mostly made up of miscellaneous property damage, theft, and liability claims. This may seem like small claims or infrequent, but they can be just as costly as any other claim.

Property damage falls under an extensive range of events. This could be a neighbor kid throwing a baseball through your window, your new teen driver pulling straight into the garage door, or any other “freak” accident that damages some part of your home. This coverage includes any vandalism, intentional damages, or any other human-induced property damage, as opposed to nature-induced damage from weather.

Theft claims occur when a homeowner experiences a break-in and has item loss or property damage such as a broken window or pried open door due to thieves. Sometimes insurance companies will offer premium discounts if you install a home security system, which can be highly beneficial to ensuring your safety and letting you rest easy. But know that if a theft does occur, you can always file a claim.

Lastly, liability claims are filed when a personal injury occurs on your property. Say a friend or family member visits, and they have an injury accident in your backyard. This liability insurance should cover those types of accidents, but these claims can end up being relatively high as you are covering any medical costs for that person. Paying out of pocket would be very damaging to most homeowners, so having liability insurance is very important.

As you can see, needing to file a claim on insurance as a homeowner can happen at any time, in any way, and you can get most things covered. Always read through your policies thoroughly and ensure coverage for things you believe you’ll need. For example, in areas prone to severe thunderstorms and weather, your homeowner’s insurance should already include a lot of common occurrences, but always make sure.

Which of These Claims Are Most Likely to Result in a Rate Increase? Or Prevent a Policy Renewal?

Of these commonly filed claims, some are seen as more detrimental or are more likely to recur, which causes them to automatically trigger premium increases or put your coverage in jeopardy. The claims most likely to increase your insurance rate include:

- Water Damage

- Fire

- Theft

- Liability

If you consider filing a claim for any of the above losses, slow down and really think about whether it’s worth the trouble and the risk of a higher premium. For instance, if you had $2,500 worth of goods stolen from your home, and you have a $500 deductible—that claim is worth the $2,000 you’ll get to help recoup those losses. So any rise in premium might be minimal in comparison. But if you have $1,000 of goods stolen from your home and a $500 deductible, then maybe it’s not worth risking a higher premium in exchange for just $500 of out-of-pocket loss.

The same goes for water damage. If the damage is minimal and you can repair it yourself for a minimal cost, it might be a better option than tainting your insurance with a small claim. On the other hand, more considerable damages and costly liability suits should definitely be something to consider filing a claim for. But don’t be surprised if your rate increases or the insurance company applies other penalties, particularly if it’s a second or third occurrence of a claim.

Other Reasons Your Homeowners Insurance Premium Might Increase

Several factors go into whether or not your insurance premium gets an increase after a claim. These factors include:

- The state you live in

- The type of claim filed

- The frequency of claims filed

- Claims history of you or your property

- Your insurance company

- Living in a storm-prone area

- Living in a high-crime area

Many insurance companies will tell you that your homeowner’s insurance policy is not intended for maintenance. It is intended to help you in times of need and protect you from paying out of pocket for unexpected expenses. So, high rates of small claims can raise your premium, and some insurance companies may even drop you for filing so many claims, no matter how small.

Insurance companies will see homeowners who file even one claim at risk for future claims, and if you are filing more frequently, insurance companies will see you as high-risk. High-risk homeowners cost insurance companies a lot of money, which is why premium increases or dropping customers are options to mitigate that on their end.

How Big of an Increase Can I Expect?

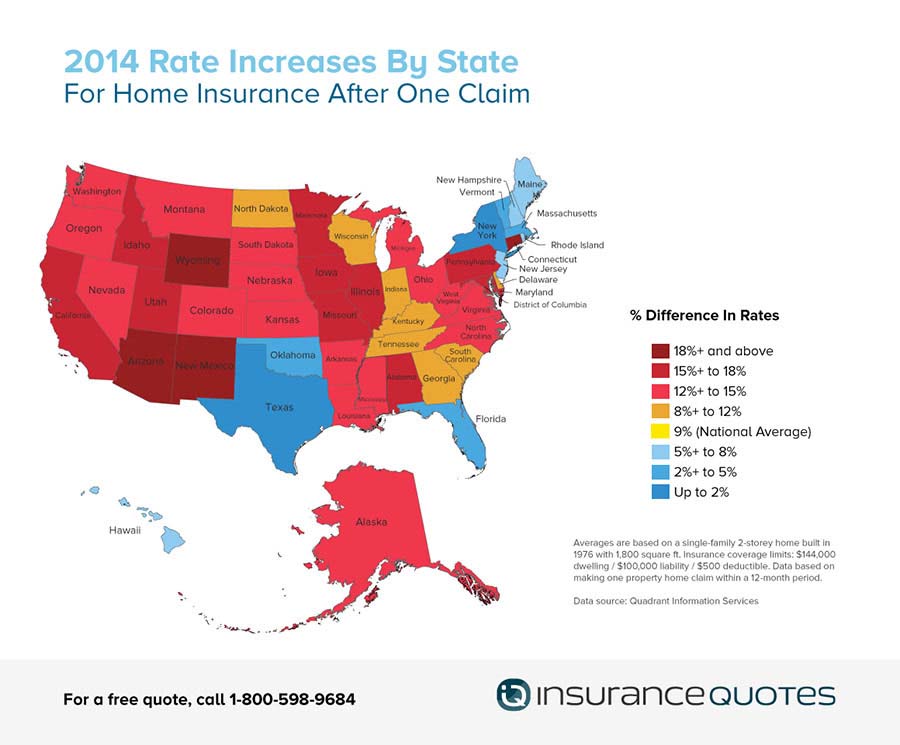

Like we said above, it really depends on several factors to determine whether or not your premium will increase and how much it will increase. The percentage increase in premiums can also fluctuate quite drastically each year, so it’s hard to nail down exact numbers. But, a 2014 study by InsuranceQuotes.com gives a nice visual of how different states raise or don’t raise premiums based on a homeowner filing a single claim.

As you can see, many coastal states, some that may be affected by hurricanes, do not immediately raise insurance premiums after one claim. Texas has a law that your insurance company cannot raise your premium if you file one claim. On the other side of that, Florida is known for having the highest rates for homeowner’s insurance premiums in the country, likely due to the increased risk of damage from hurricanes and tropical storms. But luckily, one claim will not make those premiums even higher.

If a homeowner files a second claim, those percentages can go way up, almost double the increase you would see on a first claim. There’s just no way around it in many states, and it can be an incredibly competitive market. If you do notice your insurance premium goes up, you can always shop around and try to find a better company or one that would negotiate a lower rate for you.

Is There Any Way to Prevent Premium Increases?

Insurance companies will often provide premium discounts if you take certain precautions and safety measures to mitigate the risk of damage to your home. Risk mitigation can include obvious things like having working fire and carbon monoxide detectors. You can and should also have a fire extinguisher.

Living close to a fire station can also benefit you as well as maintaining any sprinkler systems. Installing a home security system and ensuring ways to secure your valuables with a locked safe, for example, can bring you a discount.

Also, to mitigate liability claims, which can be the most expensive, you should always take safety precautions when having people over to your home. For example, if you have a pool, ensure you have life jackets for children, life preservers within reach to toss to someone, and know how to spot drowning.

You can also mitigate alcohol consumption and other factors that could lead to personal injury on your property. These steps may not bring you an immediate discount on your premium, but they can prevent having to make a liability claim in the future.

And in the end, try to only file catastrophe claims. One obvious way to prevent your home insurance rates from going up and potentially getting a claim-free discount is to be picky about submitting insurance claims. If your home sustains minor damage and it’s something you can easily pay for with your own money, that may be your best course of action. Save home insurance claims for weather catastrophes or significant property loss.

Mitigating Risk to Avoid Insurance Claims in the Future

In addition to the things we listed above regarding insurance discounts, there are some ways you can continue mitigating risk to keep you, your family, and your home safe from any issues or harm (and avoid filing claims).

- Keep valuables safely stored away from other items that can easily cause harm or damage. If you have a gun cabinet, make sure it’s locked. You can also have a locking safe to mitigate any risks of theft or personal injury.

- Make sure all entrances to your home are well-lit or have proper lighting installed. Having brighter lights at nontraditional times can deter crime as well. Also, make sure there are no security gaps by checking around doors for cracks or damage. If you can fit a finger under the door, it’s time for repair.

- Always ensure that your home is protected from any weather damage by checking any shingles or tiles on your roof. If you’re due to replace something, make sure you do it before a storm hits to avoid paying a hefty deductible.

- Check your fire extinguisher and smoke alarms regularly to ensure they’re functional and placed in the proper areas.

- If there are standing water issues, fix them as soon as possible to avoid any future problems with mold growth which can be hazardous to your health.

- Make sure you have the proper drainage systems to ensure any excess water from storms will not flood your basement. Installing a quality sump pump is one way of doing so, as well as making sure you have no standing water or issues with blocked drains. Make sure all your outside drainage pipes are clear and well maintained.

As you can see, increases in your premium depend on many things, but for the most part, you can expect some increase after your first filed claim. Your best bet to avoid this is to ensure you have adequate coverage, mitigate your risk, and do your research in your area to make sure you get the best insurance at the best rate. Plus, you can be better prepared by knowing what to expect if and when you need to file a claim.

We can face some pretty damaging weather in the Upper Midwest with tornadoes and severe thunderstorms, so we know the ins and outs of insurance claims for weather incidents. For more information on storm damage claims, check out our storm damage page. And if you find yourself facing some damage to your roof or siding, give us a call at (608) 247-5946. We can help walk you through the process.